Sales Tax Settings & Shipping

Sales Tax Settings & Shipping

Configure Local Sales Tax & Shipping

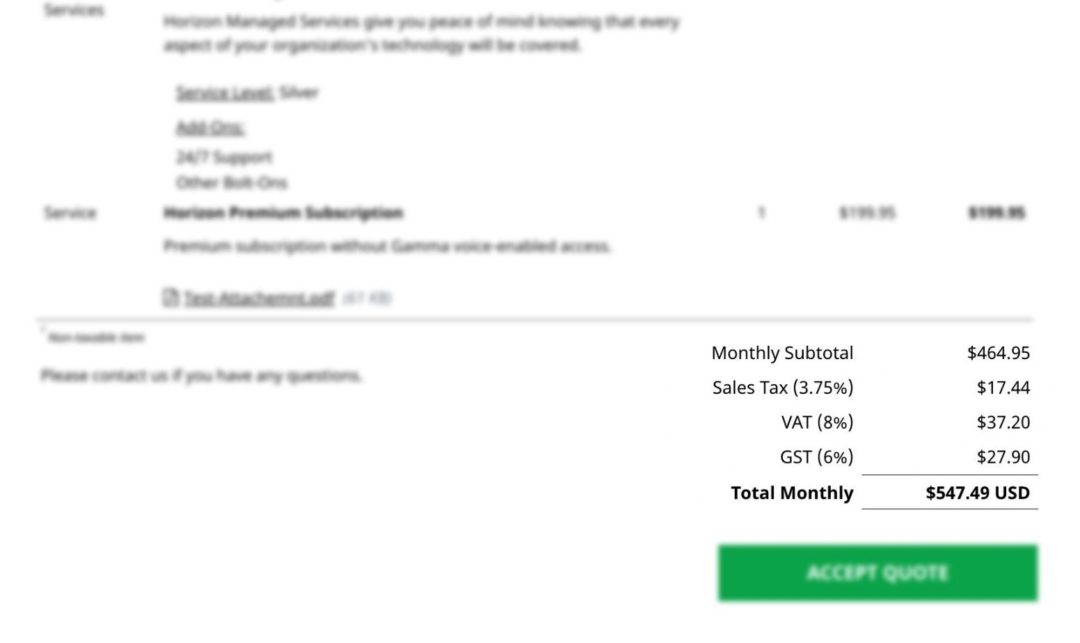

Quoter supports custom shipping and tax rules so you can ensure quotes are calculated accurately, no matter where your customers are from. Tax rates can be defined at the time of creating a quote as well, for Value-added Tax (VAT), Duties or other Specialty tax.

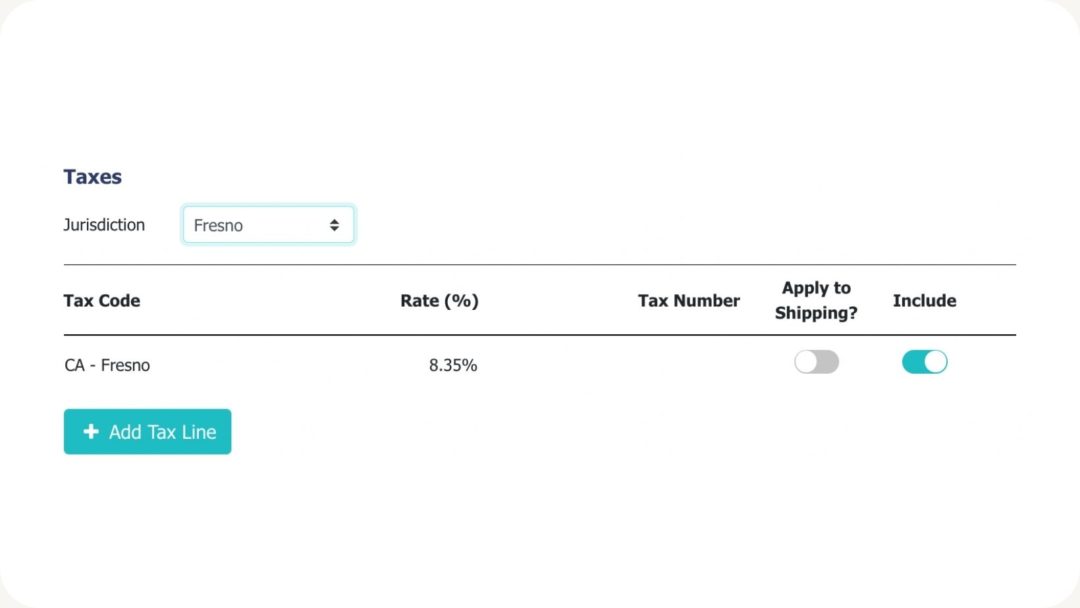

Display properly formatted county, local or municipal tax

Tax jurisdictions shouldn’t slow you down or leave you prone to errors when creating quotes. On the receiving end, your customers can clearly see the taxable amount added to their quote, and its correct labelling.

Shipping Controls

Specify if a given tax should apply to shipping costs or not, so you don’t have to do this at the time of creating a quote.

With our Sales Tax Settings, you can

-

Define Tax Codes for federal, state and provincial tax rates

-

A default tax jurisdiction can be set for a given province or state

-

Shipping costs can be tax-exempt or included

-

Define tax jurisdictions for local, county or jurisdiction tax

-

Multiple tax jurisdictions can be added within one jurisdiction code

Automate your sales tax rates with our Avalara Integration

Quoter integrates with Avalara Tax (AvaTax) to automate your tax compliance and ensure your local tax codes are added correctly to your quotes.